Navigating the Impact of EU Antitrust Rulings on Google Search: Opportunities for UK Mortgage Advisers

Recent rulings by the European Court of Justice have reshaped the way Google operates its search services across Europe (including the UK). These antitrust decisions are designed to promote fair competition by reducing the dominance of Google’s own products within search results. For UK mortgage advisers, this creates a valuable window of opportunity to improve visibility online.

What the EU Decisions Mean

The EU’s interventions are intended to give smaller businesses and independent platforms a stronger chance to appear prominently in search results. By limiting Google’s ability to prioritise its own services, the changes open the door for advisers and specialist directories to gain more attention from potential clients.

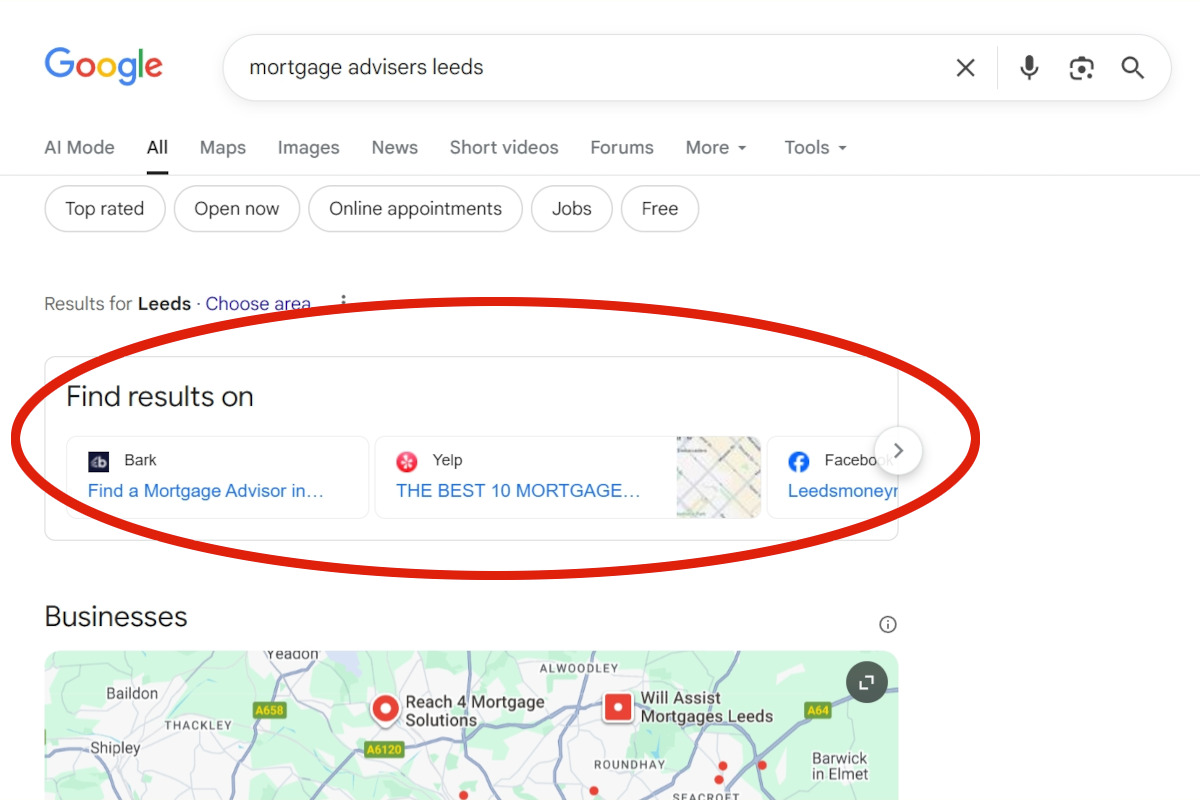

Spotlight on the “Find Results On” Feature

One significant development is Google’s “Find results on” feature. This functionality showcases links from third-party sites—often placing them above Google’s own business listings. For advisers, this means that being included in trusted directories now directly boosts your chances of appearing where clients are actively searching.

Why Directory Listings Matter More Than Ever

To make the most of these changes, mortgage advisers should ensure they are listed on reputable industry platforms. Directories act as recognised sources of information, and Google increasingly draws on them when serving results.

Benefits include:

-

Greater visibility: Multiple directory listings increase the likelihood of appearing in the “Find results on” panel.

-

Trust and credibility: Reviews and listings in respected directories strengthen client confidence.

-

SEO advantages: Quality backlinks from directories can improve your own site’s search performance.

Taking Action

Mortgage advisers who want to expand their online reach should focus on building a strong presence in industry-specific directories. A great place to start is Mortgage Adviser Directory, where you can create a free listing to connect with more potential clients.

Final Thoughts

The evolving digital landscape demands a proactive approach. By capitalising on Google’s new features and the EU’s push for fairer competition, mortgage advisers can strengthen their online presence, improve credibility, and attract more clients. Strategic directory listings are no longer optional—they’re a vital part of staying competitive.