Adviser Benefits

- Home

- Adviser Benefits

Add Your Free Listing Now

Attention all UK-based advisers! Looking to boost your online presence and reach more clients?

Mortgage Adviser Directory is an innovative online platform designed to connect residential and commercial mortgage advisers, bridging loan brokers, and equity release specialists with clients seeking expert financial advice.

Our directory serves as a comprehensive resource, enabling advisers to enhance their visibility, expand their client base, and ultimately grow their business.

How Mortgage Adviser Directory Works for Advisers

With more than 80% of all mortgages now being written by intermediaries, there’s never been a better time to be a broker.

Customers are searching for the best residential mortgage advisers, commercial mortgage brokers, bridging loan brokers and equity release advisers for face-to-face, online and telephone advice.

A listing at Mortgage Adviser Directory will ensure you stand out from the crowd.

Join thousands of advisers already receiving regular, targeted leads. Let’s take a closer look at the benefits and what’s included.

Say Goodbye to Expensive Leads That Don't Convert

At Mortgage Adviser Directory, we don’t charge upfront for leads. We’re so confident you’ll like our leads, we’ll give you the first five completely free of charge to try out our service.

After that, if you’d like to continue, just send us a copy of your standard introducer agreement for us to sign, and you’ll only pay for the leads you convert.

By instructing Mortgage Adviser Directory as an introducer, there’s absolutely no risk and you’ll be protected by the terms of your introducer agreement. If you’re not completely satisfied, you can end the agreement at any time.

New Advisers – 5 Free LeadsFree

Cost Per Listing Duration : Unlimited days

-

For UK-based advisers new to our platform

-

Suitable for individual advisers or firms

-

Takes less than 5 minutes to setup

-

Add multiple listings to different categories and locations

-

No upfront costs

-

Receive 5 free leads to try before deciding if you'd like to continue

-

Exclusive, real time leads sent directly to you only

-

Inclusion in our adviser matching service after one genuine customer review

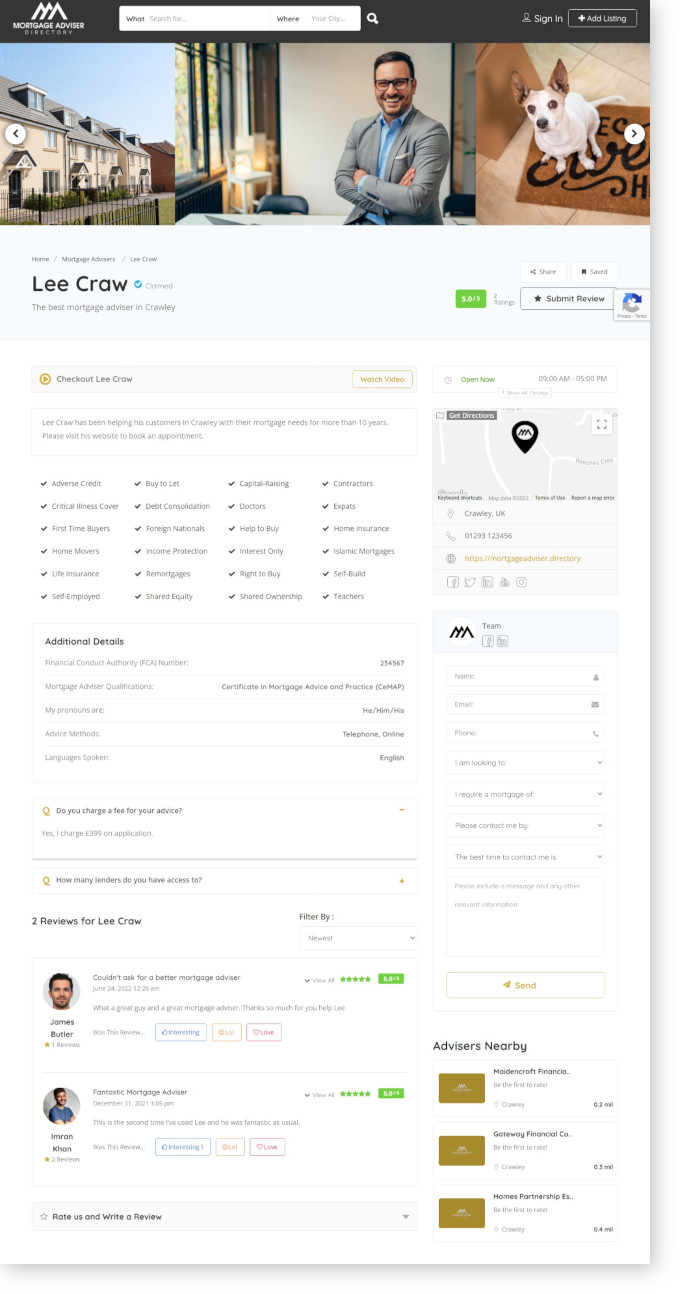

What Will My Listing Look Like?

The following features are included with your listing:

Image Gallery & YouTube Video

Your listing will really standout with your professional images and video.

Business Description

Create a unique description to promote your services to potential customers.

Specialties

Let customers know what you specialise in.

Additional Details

Highlight your qualifications, response times, languages you speak, compliance information and FCA number.

FAQs

Answer your customers’ frequently asked questions.

Real Customer Reviews

Encourage your customers to share their experiences of dealing with you.

Address & Google Map

Display your address and a map so customers can find your place of work.

Business Hours

Allow your customers to contact you while you’re open and available to handle their enquiries.

Lead Form

Customers can contact you from your listing, sending you their contact details, best time to contact them, what they’re looking to do and how much they need to borrow.

Deals / Offers / Discounts

Promote your current special offers, differentiating you from your competitors.

Submit Blog Posts

As an expert in your field, our website visitors want to hear from you. Why not submit a post to our blog?

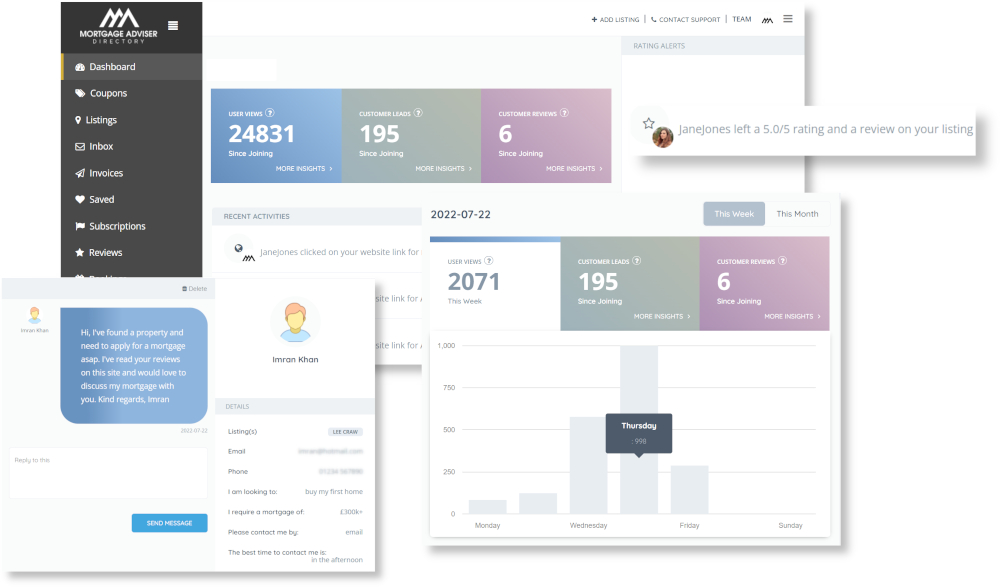

Adviser Dashboard

Your account comes with your own dashboard where you can manage your listing(s), view daily, weekly and monthly listing traffic and lead statistics, and receive rating/review alerts and respond in real time.

You can also respond to customer leads directly from your dashboard.

Frequently Asked Questions

Mortgage Adviser Directory is focussed completely on the UK market. Unfortunately, as regulations are different in each country, we cannot currently accept listings from outside the UK.

Please register with the email address you’d like your leads to be sent to.

If you’re intending to add listings to multiple categories and/or locations and you’d like the leads from each listing to be sent to different email addresses, you’ll need to create a separate user account for each listing.

The email address you use will need to be from the some domain as your website.

Any listings with at least one genuine customer review are automatically eligible to be included in our adviser matching service.

If we’ve already added a listing for your business to our directory, we’ll usually be in touch once you’ve started to receive some free leads.

If you’d like to claim your listing, please drop us an email at team@mortgageadviser.directory

This is completely according to your preference. You could do both.

It’s worth considering the following:

- – Are all your advisers based in one location? If not, you could attract customers from multiple locations by adding the advisers individually.

- – Would you like all of your advisers’ customer reviews under one listing, or a listing for each adviser, each with their own reviews?

You can add a maximum of 5 images. We recommend adding a minimum of four (inluding your logo).

You can upload .jpg, .jpeg, .png or .gif images to your listing.

We recommend images of no more than 750 x 500 pixels.

Please do not upload marketing banners with text, as these will be removed.

You can add a YouTube video to your listing. Please entre the url of the video, which begins with https://youtu.be/

Follow our top tips to get more leads from your listing.

We’re always looking for interesting, useful and inspiring articles for our mortgage blog. As a residential mortgage adviser, commercial mortgage broker, bridging loan broker or equity release adviser featured in our directory, you’re truly an expert in your field and our website visitors want to hear from you.

By submitting a blog post you’ll:

– share your knowledge and experience for the good of our visitors

– gain invaluable exposure and recognition for you and your business

Your blog post should:

– be supplied in a Microsoft Word document

– be written in English and be at least 500 words long

– be completely unique and not published anywhere else online, as this can result in search engine penalties for duplicate content

– only include relevant links and images you have permission to use (we can choose a suitable image for your article if you don’t already have one)

– be of a non-promotional nature. The post must be useful and informative, not just an advertisement for your business.

To submit your mortgage blog post, please email it to blog@mortgageadviser.directory

Please note:

– We can’t promise that we’ll publish your article or how quickly we’ll publish it, but we’ll certainly let you know if we do.

– We reserve the right to correct any spelling or grammatical errors and may add a disclaimer to the bottom of your article.

– We will not accept any paid submissions that compromise the quality of our blog.