Looking for a Mortgage Adviser in Birmingham?

Are you in search of a mortgage advisor in Birmingham? Look no further. Our Birmingham mortgage adviser directory features a variety of highly qualified and experienced mortgage advisers who can help you find the perfect mortgage option for your needs.

Whether you’re a first time buyer or a seasoned property investor, the Birmingham mortgage advisers in our directory have the knowledge and resources to guide you through the mortgage process with ease.

Browse our directory today to find a mortgage advisor in Birmingham.

Find a Birmingham Mortgage Adviser Today

Search our directory to find the best-rated mortgage advisers in Birmingham. Here are a few to get you started:

About the Birmingham Property Market

Why buy a residential property in Birmingham?

As the second-largest city in the UK and a cultural hotspot, Birmingham is an attractive location for property buyers. With a thriving economy and excellent transport links, it’s no wonder that demand for property in Birmingham is on the rise.

Property prices in Birmingham are high in comparison to many other parts of the UK, with the average price sitting at £259,821 last year.

Living in Birmingham will give you the chance to see the very best that this multi-cultural haven has to offer.

Property purchasing is not without stresses and by using a mortgage adviser who has a strong knowledge of both the property market and Birmingham itself, will help make the process smoother for you.

Why buy a BTL property in Birmingham?

Like most major cities, rental properties are hugely expensive which makes home ownership more appealing to many, not to mention the returns you can make on properties in Birmingham.

With that in mind, the demand for rental properties is still booming, as there are many that cannot afford to make the move on to the property ladder, making Birmingham an ideal location if you are looking for a buy-to-let (BTL) property.

Here are some of the top benefits of buying property in Birmingham:

Thriving economy – Birmingham has a diverse economy, with key sectors including finance, healthcare, and creative industries. This means there are plenty of employment opportunities in the city, making it an attractive location for professionals and families alike.

BTL opportunities – Birmingham is home to several universities, including the University of Birmingham and Aston University, and the estimated student population is around 80,000. This, combined with an average rental yield of 6.56% and the city’s growing population, makes it an ideal location for buy-to-let investors.

Excellent transport links – Birmingham benefits from excellent transport links, including the West Coast Main Line and several major motorways. The city is also home to Birmingham Airport, which offers international flights.

Strong investment – Like London, Birmingham’s property market is considered a reliable and profitable investment. Even during times of economic uncertainty, house prices in Birmingham have remained stable.

Living in Birmingham

Birmingham is a vibrant and diverse city, with plenty to offer residents. From independent cafes and shops to world-class museums and galleries, there’s something for everyone in this bustling city.

Birmingham is also home to several beautiful parks and green spaces, including Cannon Hill Park and Sutton Park, which offer a welcome escape from the hustle and bustle of city life.

In addition to its parks and green spaces, Birmingham has a lot to offer in terms of shopping, nightlife, and culture.

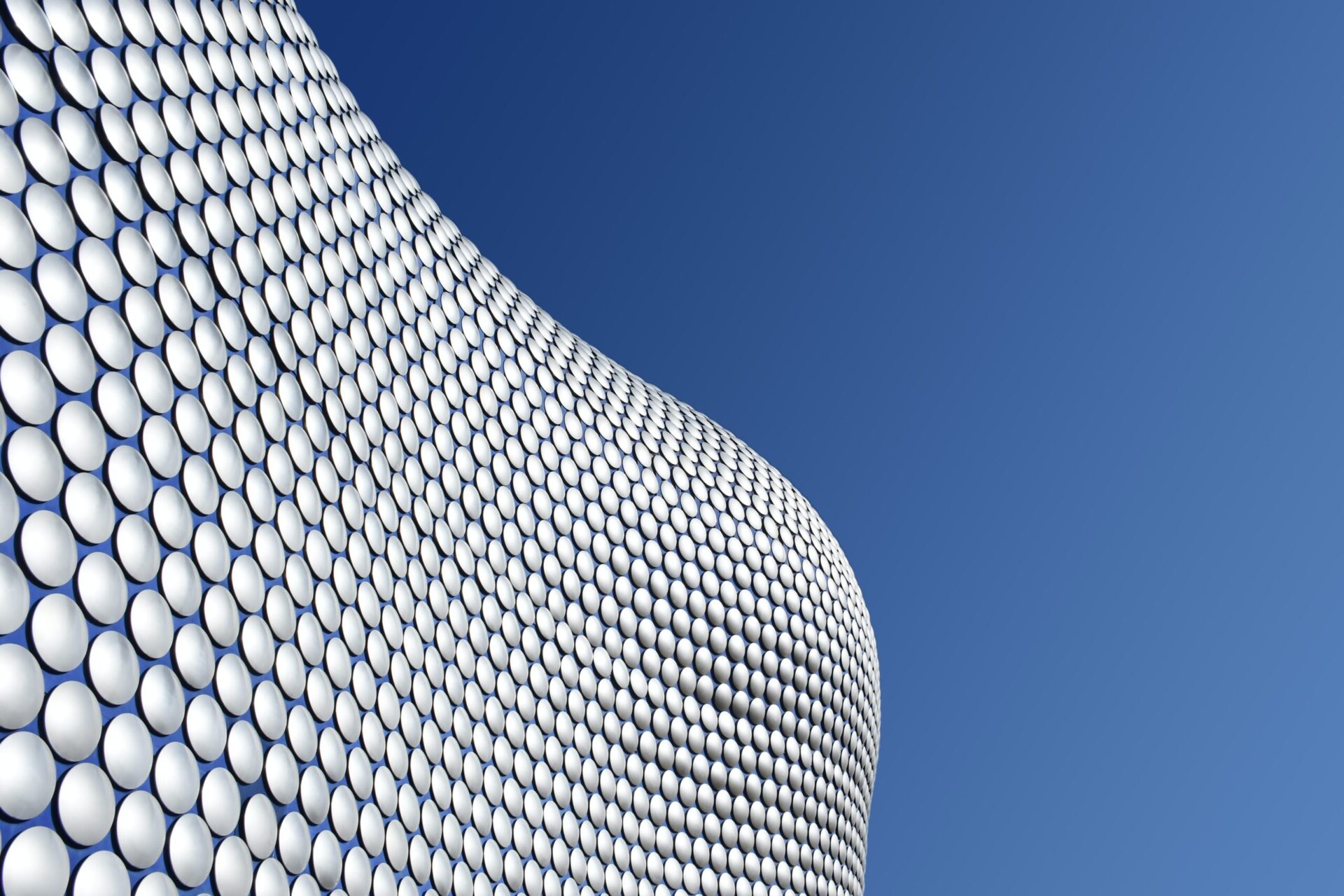

The Bullring & Grand Central is a must-visit for shoppers, offering over 200 stores and restaurants in one location. The Mailbox is another popular shopping destination, with high-end designer stores and a selection of restaurants and bars. The city also has several markets, including the famous Bullring Open Market and the Indoor Market, which offer a variety of fresh produce and unique goods.

When it comes to nightlife, Birmingham has a diverse range of options to suit all tastes. The city’s club scene is renowned having hosted some of the biggest DJs in the world. There are also plenty of live music venues, including the O2 Academy and the Symphony Hall, which regularly host concerts and events. If you prefer a more laid-back night out, there is a great selection of bars and pubs in the city centre and surrounding areas.

Birmingham is also a city rich in culture, with a wealth of museums, galleries, and theatres. The Birmingham Museum and Art Gallery is a must-visit, with an impressive collection of artwork and artefacts from around the world.

Overall, Birmingham is a city with a lot to offer, from its vibrant nightlife to diverse shopping, and whether you’re a young professional, family or investor, there’s something for everyone in this bustling and welcoming city.

About Birmingham Mortgage Advisers

Why choose a Mortgage Adviser in Birmingham?

Whether you’re looking for a new mortgage for your home, investing in a buy-to-let property, or considering remortgaging, knowing where to start and which deal is best for you can be challenging. With a variety of mortgage advisers in Birmingham available, here are our top reasons why selecting a local mortgage adviser in Birmingham can be advantageous for your search.

Expertise in the Local Market: The mortgage advisers in our directory are well-acquainted with the Birmingham property market. They understand local trends, property values, and lending criteria specific to the area. This knowledge enables them to provide personalized advice that takes into account your unique circumstances and financial goals.

Wide Range of Lenders: When it comes to mortgages, having access to a broad panel of lenders is essential. Local mortgage advisers in Birmingham have established relationships with various lenders, including banks, building societies, and specialist mortgage providers. They can compare mortgage products from multiple sources to find the most suitable options tailored to your needs.

Save Time and Effort: Searching for the right mortgage deal can be time-consuming and overwhelming. The advisers in our directory will handle the legwork for you, saving you valuable time and effort. They will manage the paperwork, communicate with lenders on your behalf, and guide you through the entire mortgage application process.

Unbiased Advice: The primary focus of these advisers is to find the best mortgage solution for you. The advice you receive is impartial and solely based on your best interests, helping you make informed decisions and secure the most favourable mortgage terms.

Tailored Solutions: Everyone’s financial situation is unique, and our listed mortgage advisers in Birmingham recognize this. They take the time to understand your specific needs, financial goals, and affordability before recommending suitable mortgage options. Whether you have a complex income structure, credit issues, or require a flexible repayment plan, these advisers will work diligently to find a tailored solution.

Continual Support: The commitment of these advisers doesn’t end once your mortgage deal is signed. They will continue to provide ongoing support and guidance throughout the life of your mortgage. They can assist with periodic reviews, explore refinancing opportunities, or advise you on related financial matters.

Find a Birmingham Mortgage Adviser Today

When searching for a mortgage adviser in Birmingham, you’ll find a variety of experienced professionals ready to assist you. Local advisers have in-depth knowledge of the Birmingham property market and can help you navigate the mortgage process with ease, ensuring you find the best options available for your needs.

Working with a mortgage adviser in Birmingham provides the advantage of personalized service, as they understand the unique aspects of the local market. They can guide you through various mortgage products and advise you on securing the most favorable terms, saving you time and potentially money.

Whether you’re a first-time buyer, looking to remortgage, or investing in a buy-to-let property, a Birmingham-based mortgage adviser can offer valuable insights and support to help you make informed decisions.

Search today using our Birmingham Mortgage Adviser Directory to find a mortgage adviser in Birmingham who can assist you on your journey to securing the perfect property in this dynamic city.