Are you in need of a Mortgage Adviser in Bristol?

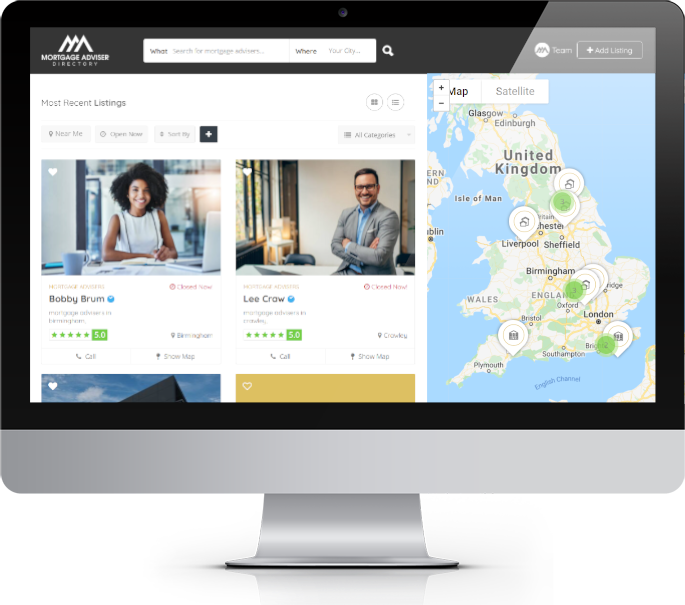

Our directory features a wide range of professional and knowledgeable mortgage advisers who can assist you in finding the perfect mortgage option for your situation in the Bristol area.

Whether you’re a first-time buyer or a seasoned property investor, the advisers in our directory can help you save time and money on your mortgage.

Browse our directory today to find a mortgage adviser in Bristol.

Find a Bristol Mortgage Adviser Today

Search our directory to find the best-rated mortgage advisers in Bristol. Here are a few to get you started:

About the Bristol Property Market

Why buy property in Bristol?

Known for its vibrant cultural scene, stunning architecture, and thriving economy, Bristol has become one of the most sought-after locations in the UK for property buyers.

The demand for property in Bristol is high, and as a result, the average house price in 2022 sat at £333,950.

Purchasing property in Bristol can be challenging, particularly for first-time buyers, who may be required to provide a significant deposit. Engaging a mortgage adviser can be beneficial, as they can provide expert advice throughout the purchasing process.

By utilising a mortgage adviser with a strong knowledge of both the property market and Bristol itself, buyers can reduce stress and ensure a smoother purchasing experience.

Here are some top reasons to purchase property in Bristol:

A city with character – This exciting and unique city is renowned for its diverse mix of cultures and fascinating history. Whether you’re interested in the arts, music, or simply love exploring new places, there’s always something to discover in Bristol.

Excellent investment opportunities – The strong and growing economy of Bristol is down to a range of thriving industries including tech, creative, and finance. This makes it an excellent location for property investment, as house prices continue to rise, generating reliable returns on investment.

Great rental yields – With over 45,000 students across two universities, Bristol has a high demand for rental properties. With average rental yields of 5.1% this is a great buy-to-let spot!

Transport links – The city is well-connected, with easy access to London, Cardiff, and other major UK cities. Bristol also boasts excellent transport links, including a comprehensive bus network, multiple train stations, and Bristol Airport.

Stunning natural beauty – Bristol is surrounded by picturesque countryside, including the Cotswolds and the Mendip Hills. The city itself is also home to beautiful green spaces, such as Ashton Court and the Downs.

Living in Bristol

Getting on the property ladder in Bristol can be challenging, particularly for first-time buyers. Using a mortgage adviser can help you navigate the purchasing process and secure the best mortgage deal for your needs. Mortgage advisers in Bristol have expert knowledge of the local property market and can provide guidance on the best areas to buy in, as well as exclusive deals with lenders that aren’t widely available.

Bristol mortgage advisers can also assist with paperwork, making the application process smoother and faster. They can help analyse all costs and features of the mortgage, not just the interest rate, ensuring you have a clear understanding of the financial commitment you’re making.

About Bristol Mortgage Advisers

Why choose a Mortgage Adviser in Bristol?

Whether you’re looking for a new mortgage for your home, investing in a buy-to-let property, or considering remortgaging, knowing where to start and which deal is best for you can be challenging. With a variety of mortgage brokers in Bristol available, here are our top reasons why selecting a local mortgage adviser in Bristol can be advantageous for your search.

Expertise in the Local Market: The mortgage advisers in our directory are well-acquainted with the Bristol property market. They understand local trends, property values, and lending criteria specific to the area. This knowledge enables them to provide personalized advice that takes into account your unique circumstances and financial goals.

Wide Range of Lenders: When it comes to mortgages, having access to a broad panel of lenders is essential. Local mortgage advisers in Bristol have established relationships with various lenders, including banks, building societies, and specialist mortgage providers. They can compare mortgage products from multiple sources to find the most suitable options tailored to your needs.

Save Time and Effort: Searching for the right mortgage deal can be time-consuming and overwhelming. The advisers in our directory will handle the legwork for you, saving you valuable time and effort. They will manage the paperwork, communicate with lenders on your behalf, and guide you through the entire mortgage application process.

Unbiased Advice: The primary focus of these advisers is to find the best mortgage solution for you. The advice you receive is impartial and solely based on your best interests, helping you make informed decisions and secure the most favorable mortgage terms.

Tailored Solutions: Everyone’s financial situation is unique, and our listed mortgage advisers in Bristol recognize this. They take the time to understand your specific needs, financial goals, and affordability before recommending suitable mortgage options. Whether you have a complex income structure, credit issues, or require a flexible repayment plan, these advisers will work diligently to find a tailored solution.

Continual Support: The commitment of these advisers doesn’t end once your mortgage deal is signed. They will continue to provide ongoing support and guidance throughout the life of your mortgage. They can assist with periodic reviews, explore refinancing opportunities, or advise you on related financial matters.

Find a Bristol Mortgage Adviser Today

When searching for a mortgage broker in Bristol, you’ll find a variety of experienced professionals ready to assist you. Local brokers have in-depth knowledge of the Bristol property market and can help you navigate the mortgage process with ease, ensuring you find the best options available for your needs.

Working with a mortgage broker in Bristol provides the advantage of personalised service, as they understand the unique aspects of the local market. They can guide you through various mortgage products and advise you on securing the most favorable terms, saving you time and potentially money.

Whether you’re a first-time buyer, looking to remortgage, or investing in a buy-to-let property, a Bristol-based mortgage broker can offer valuable insights and support to help you make informed decisions.

Search today using our Bristol Mortgage Adviser Directory to find a mortgage adviser in Bristol who can assist you on your journey to securing the perfect property in this vibrant city.

Looking for advisers in another area? Browse all UK locations