Looking for a Mortgage Adviser in Leeds?

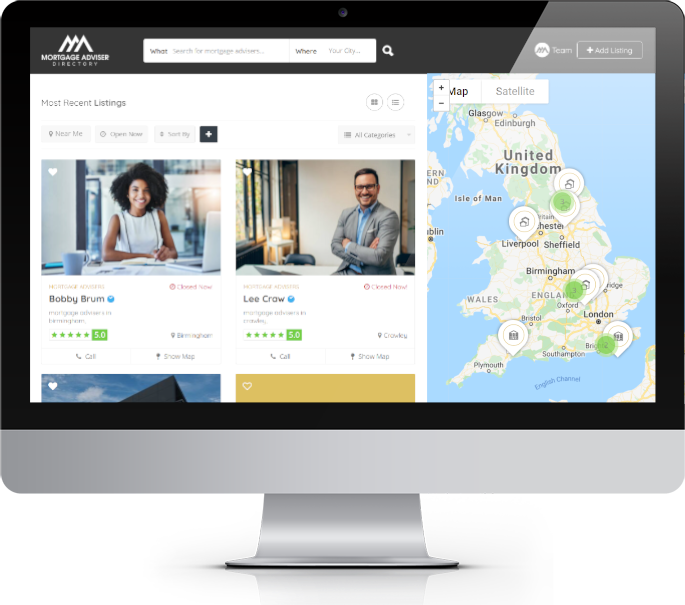

Ready to get your new mortgage and need a mortgage adviser in Leeds? We can help! Our mortgage adviser directory features many experienced mortgage advisers in Leeds and surrounding areas such as Sheffield and Manchester, who can help you find the perfect mortgage option for your new property.

Whether you’re a first-time buyer or an experienced property investor, the mortgage advisers in our directory have the knowledge to guide you through your new mortgage process.

Take a look below through our directory to find a mortgage adviser in Leeds.

Find a Mortgage Adviser in Leeds Today

Search our directory to find the best-rated mortgage advisers in Leeds. Here are a few to get you started:

About the Leeds Property Market

Why buy a residential property in Leeds?

As a dynamic city with a rich cultural heritage and a thriving population, Leeds presents an attractive opportunity for property buyers. Known for its diverse economy and excellent transport links to major cities like London and Manchester, the demand for property in Leeds is on the rise.

The property market in Leeds offers relatively affordable options compared to many other regions in the UK, making it appealing for both first-time buyers and investors.

Residents in Leeds can enjoy a vibrant urban lifestyle, featuring a wide variety of amenities, green spaces, cultural events, and a welcoming community atmosphere.

Although purchasing property can be daunting, collaborating with a mortgage adviser who possesses in-depth knowledge of the Leeds property market can simplify the process and help you make well-informed decisions.

Why buy a BTL property in Leeds?

Leeds offers a competitive opportunity for those looking to invest in rental properties, especially for individuals who find home ownership challenging. As the city continues to grow, the demand for rental properties has increased, driven by the influx of students, young professionals, and a diverse population who may not yet be able to buy their own homes.

This rising demand makes Leeds an attractive prospect for buy-to-let (BTL) investors. With its vibrant economy, excellent educational institutions, and flourishing cultural scene, Leeds provides a strong market for rental properties. Landlords can expect a steady flow of tenants seeking quality housing in key areas throughout the city.

Investing in a BTL property in Leeds not only meets this ongoing demand for rentals but also presents a valuable opportunity to achieve returns in a dynamic and thriving city.

Here are some of the top benefits of buying property in Leeds:

Thriving Economy – Leeds boasts a diverse and dynamic economy, with key sectors including finance, technology, and healthcare. This vibrant economic landscape provides abundant employment opportunities, making it an appealing location for professionals and families alike.

Buy-to-Let Opportunities – With its expanding population and wide array of local amenities, Leeds is an attractive option for buy-to-let (BTL) investors. The city’s rental market remains strong as many individuals and families seek quality rental accommodation, offering promising potential yields for landlords.

Excellent Transport Links – Leeds benefits from excellent transport connections, including direct rail services to London and other major cities, as well as proximity to major motorways such as the M62 and M1. This accessibility enhances the area’s appeal for commuters and those seeking a well-connected urban setting.

Strong Investment Potential – Leeds’ property market is viewed as a reliable investment choice. Historically, property values have shown resilience, making it a sound option for buyers looking to invest for the long term, even during periods of economic uncertainty.

Living in Leeds

Thriving Economy – Leeds boasts a diverse and dynamic economy, with key sectors including finance, technology, and healthcare. This vibrant economic landscape provides abundant employment opportunities, making it an appealing location for professionals and families alike.

Buy-to-Let Opportunities – With its expanding population and wide array of local amenities, Leeds is an attractive option for buy-to-let (BTL) investors. The city’s rental market remains strong as many individuals and families seek quality rental accommodation, offering promising potential yields for landlords.

Excellent Transport Links – Leeds benefits from excellent transport connections, including direct rail services to London and other major cities, as well as proximity to major motorways such as the M62 and M1. This accessibility enhances the area’s appeal for commuters and those seeking a well-connected urban setting.

Strong Investment Potential – Leeds’ property market is viewed as a reliable investment choice. Historically, property values have shown resilience, making it a sound option for buyers looking to invest for the long term, even during periods of economic uncertainty.

About Leeds Mortgage Advisers

About Leeds Mortgage Advisers

Why choose a Mortgage Adviser in Leeds?

Whether you’re considering a new mortgage for a property to live in, investing in a buy-to-let or remortgaging, it can be challenging to know where to start and which deal is best for you. With many mortgage advisers in Leeds to choose from, here are our top reasons why choosing a local mortgage adviser in Leeds would be more beneficial for your search.

Expertise in the Local Market: The mortgage advisers in our directory are well-versed in the Leeds property market. They understand the local trends, property values, and lending criteria specific to the area. This knowledge allows them to provide tailored advice considering your circumstances and goals.

Wide Range of Lenders: When it comes to mortgages, having access to a wide panel of lenders is crucial. These advisers have established relationships with numerous lenders, including banks, building societies, and specialist mortgage providers. They can compare mortgage products from various lenders to find the most suitable options for you.

Save Time and Effort: Searching for the right mortgage deal can be time-consuming and overwhelming. The advisers in our directory will do the legwork for you, saving you valuable time and effort. They will handle the paperwork, communicate with lenders on your behalf, and guide you through the entire mortgage application process.

Unbiased Advice: The primary focus is on finding the best mortgage solution for you. The advice you receive is unbiased and solely based on your best interests, helping you to make informed decisions and secure the most favourable mortgage terms.

Tailored Solutions: Everyone’s financial situation is unique, and our listed mortgage advisers in Leeds understand this. They will take the time to understand your specific needs, financial goals, and affordability before recommending suitable mortgage options. Whether you have a complex income structure or credit issues or require a flexible repayment plan, these advisers will work tirelessly to find a tailored solution.

Continual Support: These advisers’ commitment to you doesn’t end once the mortgage deal is signed. They will continue to provide ongoing support and guidance throughout the life of your mortgage. They can help you review your mortgage periodically, explore refinancing opportunities, or advise on other related financial matters.

Find a Leeds Mortgage Adviser Today

When searching for a mortgage broker in Leeds, you’ll find a variety of experienced professionals ready to assist you. Local brokers possess in-depth knowledge of the Leeds property market and can help you navigate the mortgage process with ease, ensuring you find the best options available for your needs.

Working with a mortgage broker in Leeds offers the advantage of personalised service, as they understand the unique aspects of the local market. They can guide you through various mortgage products and advise you on securing the most favourable terms, saving you time and potentially money.

Whether you’re a first-time buyer, looking to remortgage, or investing in a buy-to-let property, a Leeds-based mortgage broker can offer valuable insights and support to help you make informed decisions.

Search today using our Leeds Mortgage Adviser Directory to find a mortgage adviser in Leeds who can assist you on your journey to securing the perfect property in this vibrant city.

Looking for advisers in another area? Browse all UK locations